unemployment income tax refund calculator

IR-2021-71 March 31 2021. You must file Schedule 1 with your Form 1040 or 1040-SR tax return.

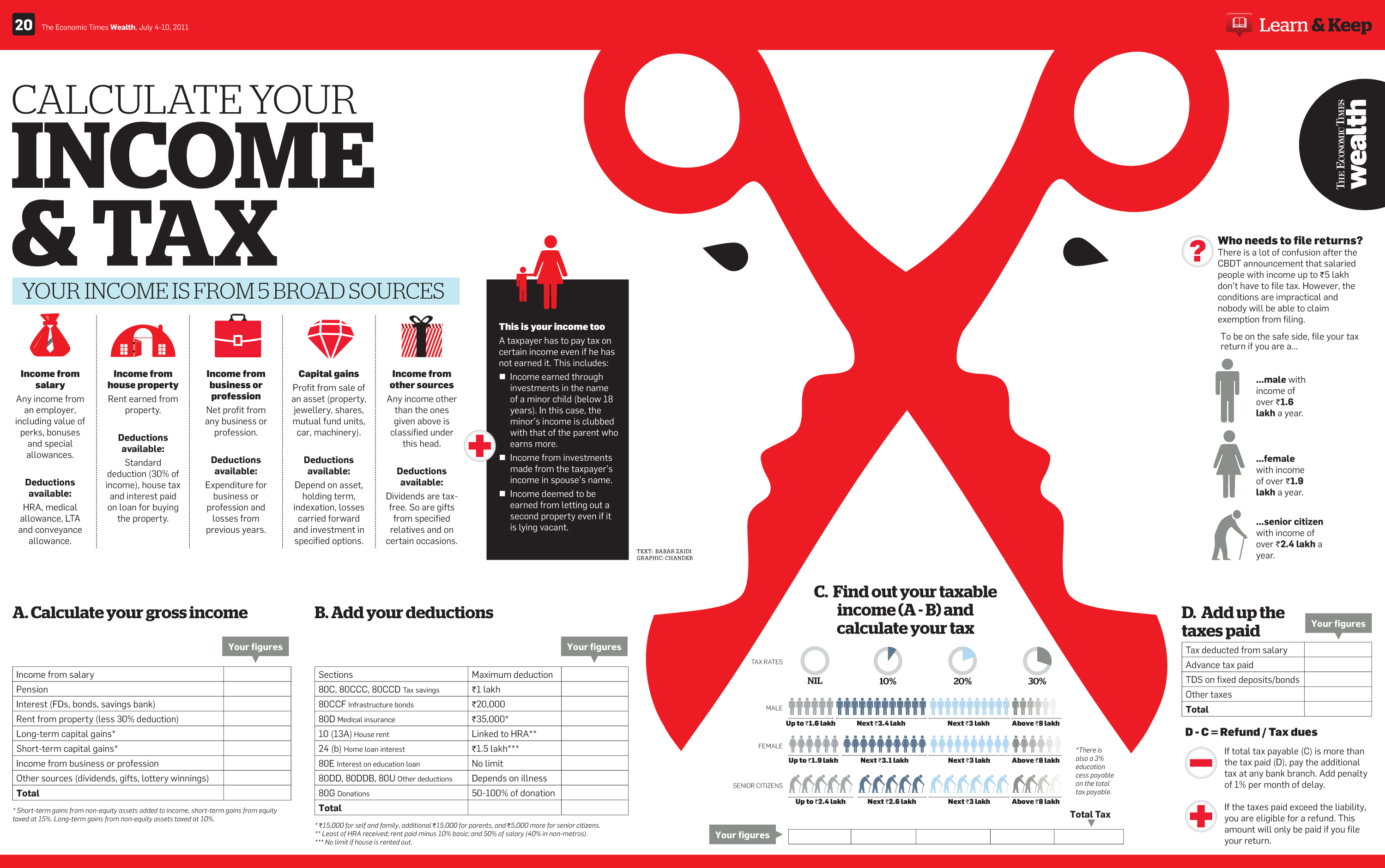

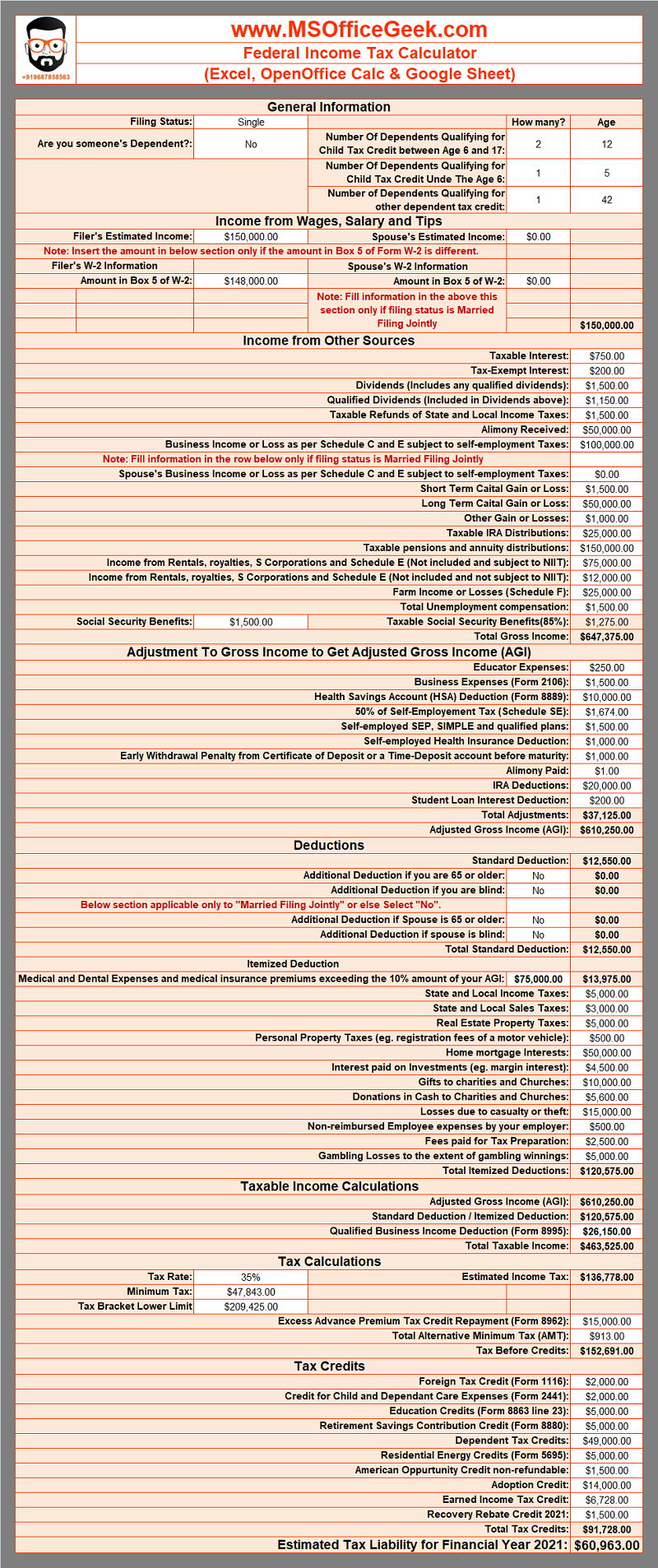

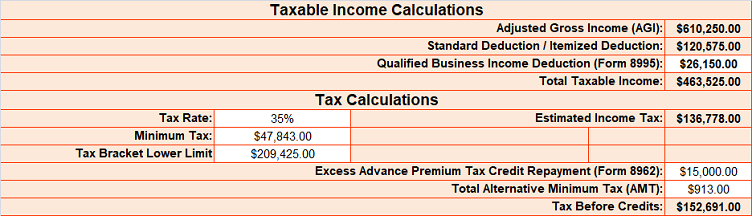

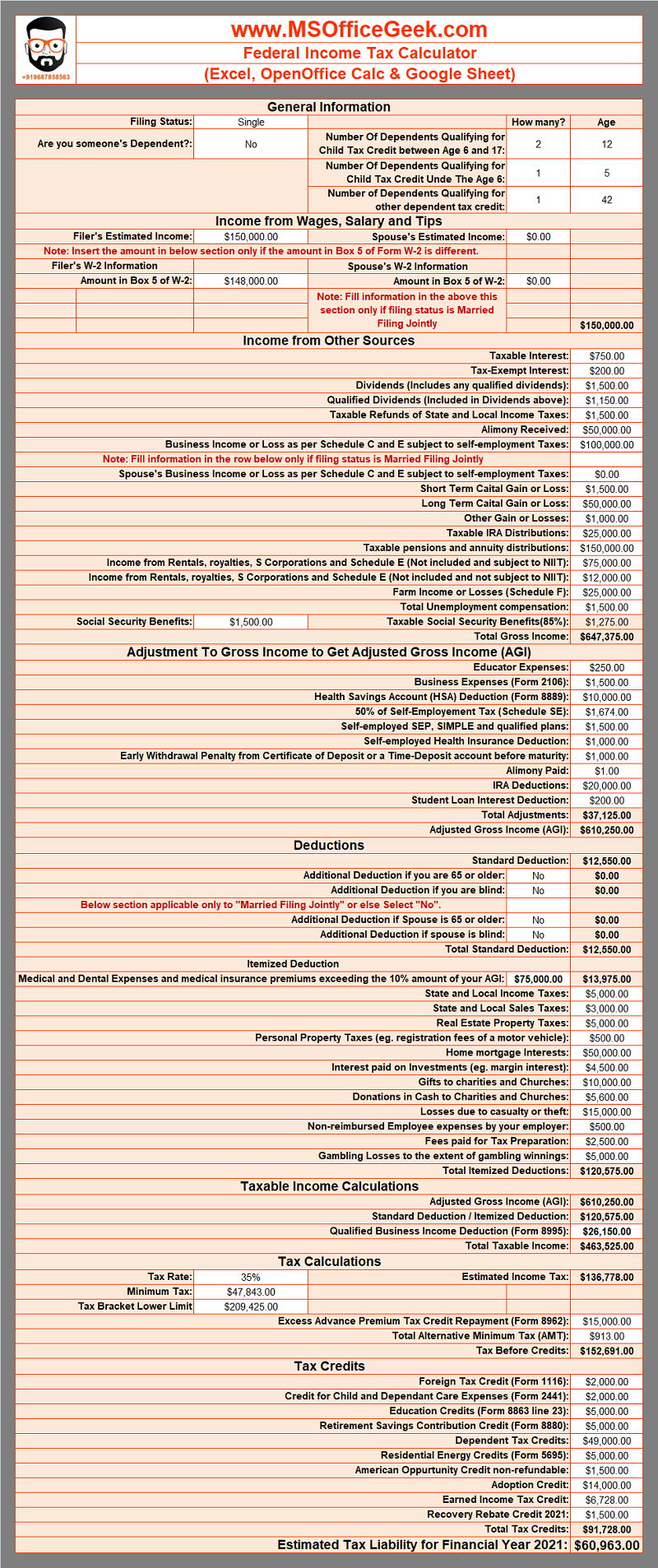

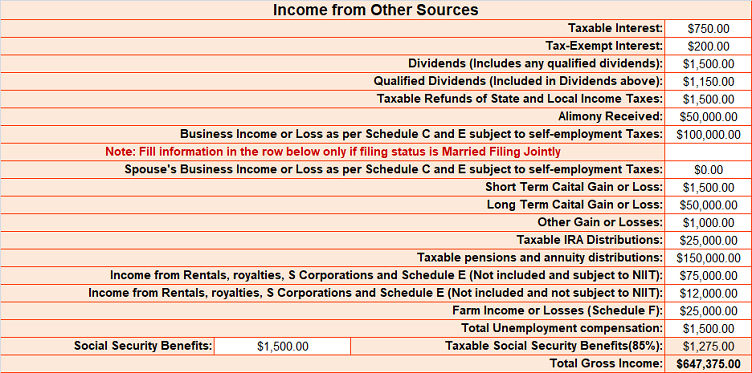

Ready To Use Federal Income Tax Calculator 2021 Msofficegeek

You did not get the unemployment exclusion on the 2020 tax return that you filed.

. Heres what you need to know. Filing with us is as easy as using this calculator well do the hard work for you. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Income Has Business or Self Employment Income. However a recent law change allows some recipients to not pay tax on some 2020 unemployment compensation.

Unemployment tax refund. Enter the figures from your form on the eFile platform and the Tax App will calculate the taxes owed on. On March 11 President Joe Biden signed his 19 trillion American Rescue Plan into law which includes a tax break on up to 10200 of unemployment benefits earned in 2020.

If you exclude unemployment compensation on your federal return as allowed under the American Rescue Plan Act of 2021 you must add. Unemployment compensation is taxable income which needs to be reported by filing an income tax return. Today employers must pay federal unemployment tax on 6 of each employees eligible wages up to.

How to calculate your unemployment benefits tax refund. The American Rescue Plan Act waived federal tax on up to 10200 of 2020 unemployment benefits per person. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax outcome.

This means they dont have to pay tax on some of it. Federal Income Tax Estimator This Tax Return and Refund Estimator is currently based on 2021 tax year tax tables. This way you can report the correct amounts received and avoid potential delays to.

You should receive a 1099-G reporting the unemployment compensation you received during 2021 to be reported on your 2021 Return in 2022. State Taxes on Unemployment Benefits. You can use this tool to calculate how you should report your hours worked when certifying weekly.

Were here for more than calculating your estimated tax refund. If you didnt have tax withheld from their unemployment payments or didnt have enough withheld in 2021 you may owe money to the IRS or get a smaller-than-expected tax refund. State Income Tax Range.

Under longstanding New York State law unemployment compensation is subject to tax which means you should report the full amount of unemployment compensation on your New York State personal income tax return. But in March the American Rescue Plan waived taxes on the first 10200 in unemployment income or 20400 for a couple who both claimed the benefit for those who made less than 150000 in adjusted gross income in 2020 in light of the coronavirus pandemic. This is only applicable only if the two of you made at least 10200 off of unemployment checks.

This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. The new tax break is an exclusion workers exclude up to 10200 in jobless benefits from their 2020 taxable income. 10200 x 2 x 012 2448 When do we receive this unemployment tax break refund.

What are the unemployment tax refunds. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. Guaranteed maximum tax refund.

Up to 10 cash back TaxSlayer is here for you. Tax refund time frames will vary. When youre ready to file your tax return for 2021 write the amount stated in box 1 of your Form 1099-G on line 7 of Schedule 1 Additional Income and Adjustments to Income.

Unemployment benefits are fully taxable in Maine. In order to be eligible for partial unemployment benefits your hours must have been reduced to less than your normal work hours through no fault of your own you must work 30 or fewer hours in a week and you must earn 504 or less in a week. So our calculation looks something like this.

Premium federal filing is 100 free with no upgrades for premium taxes. The IRS has identified 16 million people to date who. By filling in the relevant information you can estimate how large a refund you have coming.

Line 7 is clearly labeled Unemployment compensation 3 The total amount from the Additional. It is mainly intended for residents of the US. Tax Calculator for Income Unemployment Taxes.

Under the new law taxpayers who earned less than 150000 in modified adjusted gross income can exclude some unemployment compensation from their income. WASHINGTON To help taxpayers the Internal Revenue Service announced today that it will take steps to automatically refund money this spring and summer to people who filed their tax return reporting unemployment compensation before the recent changes made by the American Rescue Plan. 58 on taxable income less than 22450 for single filers.

This handy online tax refund calculator provides a simplified version of the IRS 1040 tax form. People who are married filing jointly can exclude up to 20400 up to 10200 for each spouse who received unemployment compensation. Generally unemployment compensation is taxable.

The exemption which applied to federal taxes meant that unemployment checks sent during the pandemic werent counted as earned income. And is based on the tax brackets of 2021 and 2022. Less than 44950.

This is because the american rescue plan added that the first 10200. To reiterate if two spouses collected unemployment checks last year they both qualify for the 10200 tax break. Unemployment benefits count as taxable income the unemployment income federal tax exemption does not include unemployment income for 2021.

The American Rescue Plan Act which was signed on March 11 included a 10200 tax exemption for 2020 unemployment benefits. Use smartassets tax return calculator to see how your income withholdings deductions and credits impact your tax refund or balance due amount. As soon as new 2024 relevant tax data is released this tool will be updated.

Individuals should receive a. If youre claiming the Child Tax Credit or Recovery Rebate Credit on your 2021 taxes be sure to have your IRS letter for each when you file. Taking advantage of deductions.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. Choose TaxSlayer and get your maximum refund and 100 accuracy guaranteed. The 2022 tax values can be used for 1040-ES estimation planning ahead or comparison.

President Joe Biden signed the pandemic relief law in March. There are a variety of other ways you can lower your tax liability such as. Unemployment benefits are generally treated as income for tax purposes.

Ad Free tax filing for simple and complex returns. This is the refund amount they should receive. Estimate your tax refund with HR Blocks free income tax calculator.

The IRS has identified.

How To Calculate Taxable Income H R Block

Refund Calculator Shop 52 Off Www Propellermadrid Com

Refund Calculator Shop 52 Off Www Propellermadrid Com

Netherlands Income Tax Calculator Online Aangifte24

Ready To Use Federal Income Tax Calculator 2021 Msofficegeek

![]()

Self Employment Tax Calculator Estimate Your 1099 Taxes Jackson Hewitt

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

What Are Marriage Penalties And Bonuses Tax Policy Center

Ready To Use Federal Income Tax Calculator 2021 Msofficegeek

Ready To Use Federal Income Tax Calculator 2021 Msofficegeek

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

How To Calculate The Tax In Australia Quora

China S Individual Income Tax Everything You Need To Know

Simple Tax Calculator To Determine If You Owe Or Will Receive A Refund

Tax Return Estimator 2020 On Sale 56 Off Www Propellermadrid Com